The banking industry has significantly changed its marketing strategies in recent years due to technological advancements, shifting consumer behaviors, and increased competition. As the world becomes increasingly digital, banks and credit unions must adapt to new marketing techniques to maintain a competitive edge. In this article, we will explore the future of bank marketing and the strategies banks must adapt to remain relevant in an ever-changing industry.

The Rise of Digital Marketing

One of the most significant changes in the banking industry is the shift from traditional marketing to digital marketing. With the rise of the internet and the proliferation of smartphones, customers increasingly rely on digital channels to access financial services. Banks that do not adapt to these changes risk losing customers to more digitally-savvy competitors.

Digital marketing allows banks to reach customers where they spend their time – online. Social media platforms such as Facebook, Twitter, and Instagram are becoming increasingly important for banks to connect with customers. These platforms allow banks to engage with customers in a more personal and interactive way, which can lead to increased customer loyalty and higher retention rates.

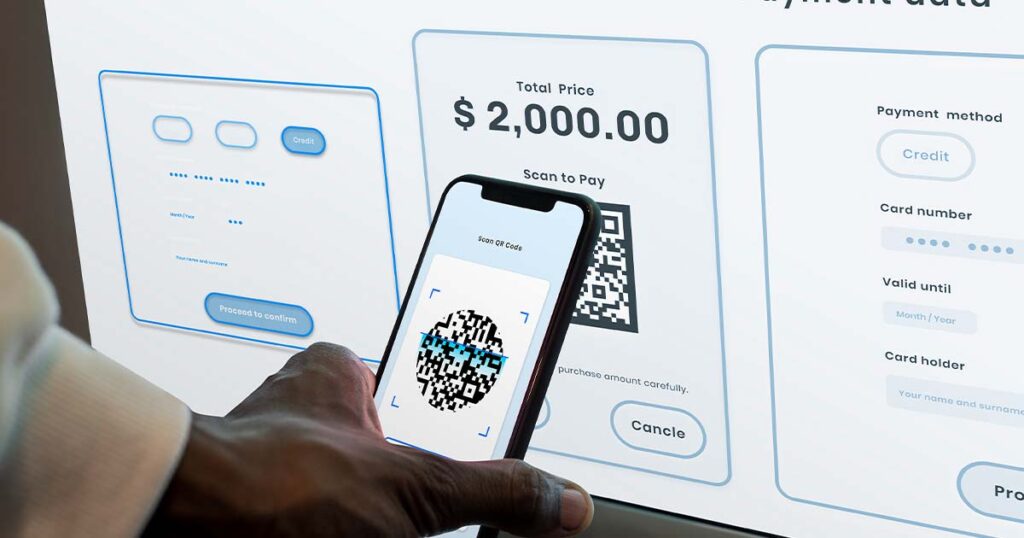

Mobile apps are also becoming essential for banks to engage with customers. Mobile banking allows customers to access their accounts, transfer funds, and pay bills from their smartphones. By providing a seamless mobile experience, banks can improve customer satisfaction and increase brand loyalty.

Personalization

Personalization is another critical aspect of the future of bank marketing. Customers today expect a personalized experience from the brands they interact with; banks are no exception. By using data analytics and artificial intelligence, banks can gain insights into customer behavior and tailor their marketing messages to each individual.

Personalization can take many forms, such as personalized emails, targeted advertisements, and customized offers. For example, a bank might use data analytics to determine that a customer is interested in travel and offer them a travel rewards credit card or a low-interest loan for a vacation. Banks can increase customer satisfaction and build stronger customer relationships by providing personalized offers.

Customer Experience

Customer experience has always been important in banking, but it has taken on even greater significance in recent years as customers have become more demanding and discerning. Banks that are able to deliver a superior customer experience that is both efficient and personalized will be able to differentiate themselves from the competition and build customer loyalty.

To achieve this, banks must invest in technologies that enable them to deliver a seamless and frictionless customer experience across all channels, including mobile, online, and in-branch. This includes developing chatbots and other AI-powered tools that can provide customers with quick and accurate responses to their queries and leveraging data analytics to personalize the customer experience and provide customized recommendations and offers.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are becoming increasingly important for banks to stay competitive in the market. AI and ML can be used to analyze large amounts of data, identify patterns, and make predictions about customer behavior. By using these technologies, banks can gain valuable insights into customer behavior and preferences, which can help them make more informed marketing decisions.

AI and ML can also be used to automate many aspects of the marketing process. For example, chatbots can be used to answer customer questions and provide support, freeing up employees to focus on more complex tasks. By automating routine tasks, banks can improve efficiency and reduce costs.

Social Responsibility

Social responsibility is becoming increasingly important for banks to build trust with customers. Customers today are more aware of social and environmental issues, and they expect the brands they interact with to take a stance on these issues. Banks that fail to address these issues risk losing customers to more socially responsible competitors.

One way that banks can demonstrate their social responsibility is by investing in green initiatives. For example, banks can offer low-interest loans to purchase electric vehicles or invest in renewable energy projects. In addition, by aligning themselves with environmental causes, banks can attract customers who are passionate about sustainability.

Another way that banks can demonstrate their social responsibility is by supporting community initiatives. For example, banks can sponsor local events, donate to charitable organizations, or offer financial education programs to underprivileged communities. Banks can build stronger relationships with their customers by supporting their communities and improving their brand image.